Unlocking the door to real estate investment, even with limited funds, is now within reach, thanks to the innovative platform, Fundrise. If you’ve ever dreamt of dipping your toes into the lucrative waters of real estate but hesitated due to financial constraints, Fundrise might just be the game-changer you’ve been waiting for.

Picture this: With as little as $500, you can step into the realm of real estate investing through Fundrise’s user-friendly interface and expert guidance. Whether you’re a seasoned investor seeking to expand your portfolio or a newcomer eager to explore new avenues of wealth creation, Fundrise opens doors that were once thought closed to many.

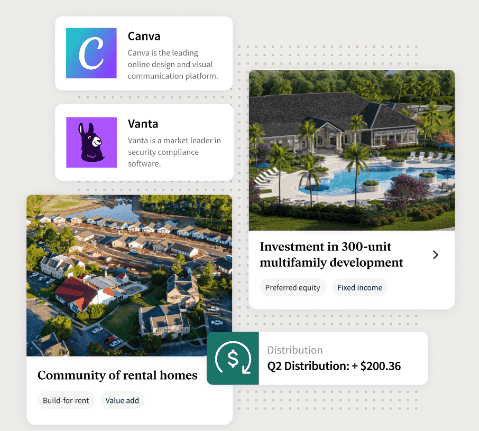

So, what exactly is Fundrise? It’s an online platform revolutionizing real estate investment by pooling resources from multiple individuals to acquire and manage a diverse array of high-quality properties. From residential havens to commercial hotspots and mixed-use marvels, Fundrise offers a slice of the real estate pie to all, without the hefty price tag or the headaches of property management.

Best eBook: A Guide on How to Run a Home Business or Remote Job

Here’s why investing in real estate through Fundrise is a golden opportunity:

Diversification: Fundrise lets you spread your investment across various properties, minimizing risk and maximizing potential returns. By investing in different asset classes and locations, you’re hedging your bets and setting yourself up for success.

Accessibility: Forget the notion that real estate investment is reserved for the wealthy elite. With Fundrise, you can start your journey with just $500. It’s an invitation for everyone to participate in wealth-building opportunities previously out of reach.

Professional Management: Say goodbye to the headaches of property management. Fundrise handles all the nitty-gritty details, from acquisition to maintenance, so you can sit back, relax, and watch your investment grow.

Passive Income: Imagine receiving regular streams of income without lifting a finger. That’s the beauty of real estate investing through Fundrise. Rental payments and potential appreciation become your allies in the quest for financial freedom.

Potential for Capital Appreciation: Real estate values tend to appreciate over time, and Fundrise positions you to ride this wave of growth. By investing in a diversified portfolio of properties, you’re tapping into the long-term appreciation of real estate assets.

But how does Fundrise work its magic? It’s simple:

Signup: Create an account on the Fundrise website with a few clicks and keystrokes. It’s a breeze to get started and requires minimal personal information.

Select Your Investment: Browse through Fundrise’s investment plans, each tailored to suit different risk appetites and investment goals. Choose the plan that aligns with your aspirations and preferences.

Investment Allocation: Once you’ve picked your plan, allocate your funds across the properties in Fundrise’s portfolio. Detailed information about each property helps you make informed decisions.

Passive Income and Returns: Sit back and let your money work for you. Fundrise distributes income generated by the properties in your portfolio regularly, with the potential for additional returns through appreciation.

Portfolio Monitoring: Keep tabs on your investments through Fundrise’s intuitive dashboard. Track performance, receive updates, and access essential documents and tax information with ease.

Best eBook: A Guide on How to Run a Home Business or Remote Job

Ready to dive into the world of real estate investing with Fundrise? Here’s how to get started:

Research and Educate Yourself: Knowledge is power. Take the time to understand Fundrise’s offerings, investment plans, and potential risks and rewards.

Create an Account: Head over to the Fundrise website and create your account. It’s the first step towards unlocking a world of investment opportunities.

Choose an Investment Plan: Select the investment plan that aligns with your goals and risk tolerance. Consider factors like expected returns, investment timeline, and diversification.

Allocate Your Funds: Once you’ve chosen your plan, allocate your funds strategically across Fundrise’s portfolio. Spread your investment to minimize risk and maximize potential returns.

Monitor and Adjust: Stay vigilant and keep an eye on your investments. Regularly review performance, stay informed about market trends, and adjust your strategy as needed.

But wait, there’s more! Here are some tips to supercharge your real estate investment journey with Fundrise:

Set Clear Investment Goals: Define your objectives upfront. Are you aiming for steady income or long-term appreciation? Having clear goals guides your investment decisions.

Diversify Your Portfolio: Don’t put all your eggs in one basket. Spread your investments across different properties and asset classes to reduce risk.

Stay Informed: Knowledge is your greatest asset. Keep abreast of market trends, Fundrise updates, and property performance to make informed decisions.

Take a Long-Term View: Rome wasn’t built in a day, and neither is wealth. Real estate investments thrive on patience and perseverance. Stay focused on your goals and trust in the process.

Regularly Reevaluate: Markets evolve, and so should your investment strategy. Periodically review your portfolio, make adjustments, and stay nimble in the face of change.

Best eBook: A Guide on How to Run a Home Business or Remote Job

Now, let’s dispel some myths surrounding real estate investing with limited funds:

Myth #1: Real Estate is Only for the Wealthy

Think again! Fundrise shatters this misconception by democratizing real estate investment. With just $500, you can join the ranks of real estate investors and chart your path to wealth.

Myth #2: Real Estate Investing is Too Risky

Every investment carries risk, but Fundrise mitigates this by offering a diversified portfolio of high-quality properties. Do your homework, understand the risks, and invest wisely.

Myth #3: Property Management is a Hassle

Not with Fundrise! Say goodbye to the headaches of property management. Fundrise handles the grunt work, so you can focus on reaping the rewards.

For beginners dipping their toes into real estate investing, here are some strategies to consider:

Invest in REITs: Start small by investing in Real Estate Investment Trusts (REITs). These companies own and manage real estate properties, offering exposure to the market without the need for significant capital.

Start Small: Dip your toes in the water with a small investment and gradually scale up as you gain confidence and experience.

Focus on Cash Flow: Look for properties that generate steady income through rental payments. Positive cash flow properties provide a reliable source of income to fuel your investment journey.

Consider Value-Add Opportunities: Explore properties with potential for improvement or redevelopment. These value-add opportunities can unlock additional value and boost your returns over time.

While Fundrise shines as a beacon of opportunity, it’s not the only star in the sky. Consider exploring alternatives like REIT ETFs, real estate crowdfunding platforms, and real estate investment clubs to diversify your investment portfolio.

In conclusion, real estate investing with limited funds is no longer a distant dream — it’s a tangible reality within your grasp. Whether you choose Fundrise or another avenue, the key is to take that first step towards financial empowerment. Start your journey today and unlock the door to a brighter, wealthier future.

Don’t miss out on Amazon’s Deal of the Week! Find great discounts and offers. Shop now.